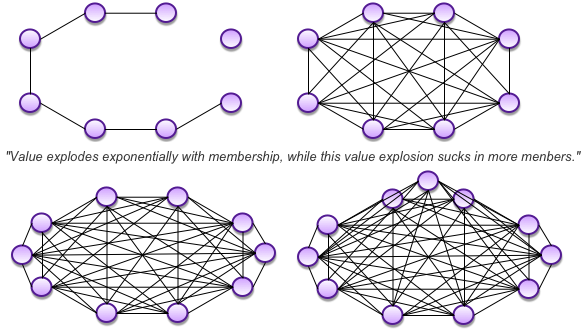

The Prime Law of Networks:

Network value increases exponentially as the number of interconnected nodes increases and the packet-size is driven towards one.

(Metcalfe’s Law combined with Lean Manufacturing). Recommended reading, The Machine that Changed the World.

Starting in Texas and Georgia in 2023, transportation and energy (Physical Internet®) can be 30% digitized by 2030 and 80% digitized by 2035. Restoring free markets will allow transportation and energy to replay the success of restoring communications to free markets in 1982.

Mobility is physical liberty. It is the ability of a person to go where they wish, when they wish, to benefit as they may only be able to perceive. We travel as individuals and families. The optimum packet size moves between one person and one family. JPods are personal, on-demand mobility regardless of age, ability, or wealth. The JPods packet-size of 1-6 people, traveling with only those in their party, drives the packet size to one trip.

Comparisons of transport networks relative to the Prime Law of Networks:

-

Roads have extremely high number of nodes with 3-8 parking space would per car. Roads would be a wonderful networks if the cost car, energy, and land were free. The problems are:

-

The cost of owning a car is between $5,265 and $9,666/year. AAA estimates the cost of new car ownership is $10,728/year. Cars are parked 95% of the time. Car ownership limited to those who can afford these costs.

-

Oil-wars since 1991 to secure access to importing oil to power 1/3rd of road transportation.

-

$30 trillion in Federal debt increasing in tandem with oil imports, the cost of oil-wars and rising gasoline prices.

-

-

Mass Transit has few nodes requiring people to adjust their needs to the timing/capacity of the network. The great benefit of mass transit is there is no capital cost to the individual.

-

JPods build niche networks. In these niches, JPods approach the on-demand service of the automobile with the zero capital cost of mass transit.

-

Drones and other options.

Sorting our the defect and benefits of these various networks requires the Wisdom of the Many (the aggregated wisdom of all of us, with each of us acting in our own self-interest, is wiser than the wisest of us at choosing between choices. The 5X5 Standard™ (granting of Rights of Way to privately funded networks 5 times more efficient than roads for 5% of their gross revenues) provides cities with a mechanism for innovator to build choices and customers to sort those choices in free markets.

Transportation and energy networks can repeat the success of restoring communications networks to free markets.

Prime Law of Networks was applied to communications after the Federal communications monopoly put in place in 1918 was returned to free markets. Metcalfe’s Law is a special case of the Prime Law applied to communications. What is “special” is that communications is by nature a single message.

History of the digitizing of communications:

- 1918: By Executive Order President Wilson monopolized communications.

- 1926 interview with Collier’s magazine: Nikola Tesla, “When wireless is perfectly applied the whole earth will be converted into a huge brain, …. We shall be able to communicate with one another instantly, irrespective of distance. Not only this, but through television and telephony we shall see and hear one another as perfectly as though we were face to face, despite intervening distances of thousands of miles; and the instruments through which we shall be able to do this will be amazingly simple compared with our present telephone. A man will be able to carry one in his vest pocket.“

- 1942: Hedy Lamarr patented the technology of WiFi and Bluetooth. The Navy rejected it until 1957-62. BlueTooth did not commercialize until 1997.

- 1963: Touch-tone telephone technology was created.

- 1968: Mother of All Demos documents most aspects of the Internet and modern computing. Start at minute 30 for 4 minutes to watch the “mouse”, video conferencing, clicking on URLs, etc….

- 1973: Cell phones were available.

- 1979: First pirate (not approved by Bell Labs) “touch-tone” telephones entered the US market. They were illegal to put on the AT&T network. Despite being illegal they began to replace rotary telephones.

- 1982: Federal courts declared the Federal communications monopoly unconstitutional and initiated a multi-year de-monopolization plan. Rotary dial telephones were still very common but being displaced by “touch-tone” phones.

- 1983: Frank Caufield invested in what would become AOL and the shift to commercializing the Internet began with bulletin boards.

- 1983 TCP/IP was implemented on ARPANET.

- 1985: AppleTalk was released.

- 1991: High Performance Computing Act shifted the Internet the commercial control using commercial standards. The dot.com boom was triggered. This was one Senator Gore’s “Information superhighway” bill.

- 1994: Today Show, “Alison, what is the Internet any way” marks wide spread public awareness of the digitizing of communications.

- 1999-2000: I was exchanging emails with Steve Jobs about JPods. He loved Segways and I wanted his help in digitizing mobility. He thought regulatory barriers would be too severe. In 2001 Apple released the iPod.

- 2007: Apple introduced the iPhone. This was the first digital phone on digital networks. SmartPhones amplified the Internet by 10X.

History of the Internet

The Internet existing decades before it commercialized. The Mother of All Demos was in 1968. Despite the fact that the technology existed, it could not commercialize until liberty was restored in 1982. Liberty is important. There is no minority as tiny and disruptive as commercial innovators. Start at 29 minutes and watch for 4 minutes to see graphical navigation and the mouse.

“Alison, what is the Internet anyway”, Today Show, 1994 newscast illustrates how expectations at one point are entirely backward sounding today. All applications of technology to networks must keep ahead of expectation to remain relevant. Networks are dynamic processes, not static technology.

Interaction between innovators and customers in niche markets is essential to sort brilliant ideas from commercially viable ones. The fact that transportation still has the gas mileage of the Model T underscores that the Prime Law of Network needs to be applied to transportation networks as it was to communications after the Federal communications monopoly was recognized as unconstitutional in 1982. We see this Prime Law of Networks is every aspect of human behavior from children playing games to the way commercial giants create economic clusters such as Silicon Valley. More work needs to be done to polish the parameters of this Prime Law of Network. As a starting point, it seems to be driven by:

-

The seed of commercialization. Brilliant ideas are a dime a dozen. Brilliant ideas can be found everywhere in society from college campuses to the back on napkins. On rare occasion, someone or a relatively small number of people find customers willing to pay to use an idea and a process unfolds:

-

If there is a profit, if the value customers willing pay exceeds the cost to compete, the idea begins to commercialize. To drive a paradigm shift, to get people to change habits, requires a 10x (10 times) increase in value or decrease in costs relative to current expectations.

-

If the implementors cycle increases in value faster than customer expectations grow, customers start recruiting their friends to become customers faster than customers abandon the idea for other options.

-

The competing idea both compete with the original value creator and add more customers choosing the value proposition.

-

If the rate of value expansion exceeds the rate expectation increase, a gravity well creates that sucks in ever more customers and competitors trying to delight them with value.

-

-

Sustained commercialization requires increasing network value faster than customer expectations grow. Brilliant giants of the tech industry such as Cray, Digital Equipment, Sun are gone because they failed to increase the value faster than customer expectations; so customers turned elsewhere for value. These companies added to the gravity well that created the economic cluster of the Silicon Valley but are no longer driving network value.

-

Societies exist because of the fundamental human need to be connected to the community. Exceeding the expectation of the community is what drives network adoption. Exceeding customer expectations is a process, not a technology. Smart thinking trumps smart devices, as brilliant devices today are rapidly tossed aside for better standards tomorrow.

-

Technology is a tool that will be displaced by better tools as expectation increase:

-

The book by Alexandra Horowitz, On Looking: A Walker’s Guide to the Art of Observation provides brilliant observations of the intricate dance people engage in while walking in a city. Any application of technology may start at current levels, but will quickly have to exceed to value expectations ingrained in people’s deep and intrinsic understanding of how connected communities move in our daily lives.

-

Solyndra was a brilliant idea but lacked the ability to exceed customer expectations of value. To be effective, every tool must exceed current expectation and be displaced by better tools that exceed the growth of expectations. Commercially valuable ideas are sorted from brilliant ideas in the crucible of profits, value customers are willing to pay for must exceed the cost to compete so strength is added to the process of innovations exceeding the growth of customer expectations.

-

-

Start Small, Iterate Relentlessly. Network Density is a critical driver. The Wired article looking at the overview of the Internet talks of this as the Law of Connections. But at the beginning of Internet adoption is was not the vast numbers of connects, but the density of connections in specific niche markets. The total number of connection is critically important to network growth, but high density concentrated in small niche markets is essential for the seed of commercialization to germinate. You cannot solve the world’s problems with traffic except by repeatedly solving someone’s local congestion. By focusing on very small implementations, such as airport economic communities, the vast majority of vehicles can be connected to create the essential density for network survival. Success in niche networks can cascade as value created exceeds rated of customer expectation increases.

-

Scaleable: Once a seed of commercialization germinates in niche solutions, is polished in that crucible, they must still provide a 10x value increase while exceeding much broader and more skeptical customer expectations to become scaleable. Each customer that is delighted with a product will tell zero to 8 people. Each person that is disappointed with tell 8 to 22 people. Overcoming all these realities is why there are so few people like Edison, Bell, the Wright Brothers, Ford, Gates, and Jobs.

-

Exponential Adoption: At some point, with luck, a tipping point will be reached as explained in the Wired article (based on Net Gain by John Hagel):

The chart of Microsoft’s cornucopia of profits is a revealing graph because it mirrors several other plots of rising stars in the Network Economy. During its first 10 years, Microsoft’s profits were negligible. Its profits rose above the background noise only around 1985. But once they began to rise, they exploded.Federal Express experienced a similar trajectory: years of minuscule profit increases, slowly ramping up to an invisible threshold, and then surging skyward in a blast sometime during the early 1980s.The penetration of fax machines likewise follows a tale of a 20-year overnight success. Two decades of marginal success, then, during the mid-1980s, the number of fax machines quietly crosses the point of no return – and the next thing you know, they are irreversibly everywhere.

Network Resiliency is the reverse of adding network connections:

Liberty creates the “general welfare” through tolerance of disruptive minorities creating choices and the Wisdom of the Many sorting those choices in a Darwinian Crucible of free markets and free speech:

-

There are few minorities as tiny and disruptive as commercial innovators.

-

The aggregated wisdom of all of us, with each of us acting in our own self-interest is wiser than the wisest of us at choosing between choices.

Government infrastructure monopolies block the offering of choices and the sorting of choices in free markets:

-

The Federal communications monopoly stifled the Internet for nearly a century of rotary telephones.

-

The Federal power monopoly wiped out the entire distributed energy industry and caused 600,000 windmills to be abandoned after 1935 Rural Electrification Administration remove energy self-reliance and sustainability as market forces.

-

The Federal-Aid Highway Act of 1916 removed efficiency as a market force causing nearly half the freight railroads in the US to be abandoned. Freight railroads average 476 ton-miles per gallon. The Federal highway monopoly has blocked the expansion of a physical version of the Internet as demonstrated since 1972 in the Personal Rapid Transit network in Morgantown, WV.

-

Climate Change, oil-wars since 1991, oil-dollar funded terrorism, and the coming Oil Famine are all consequence of Federal infrastructure monopolies.

-

The Boston Tea Party and the subsequent Revolutionary War caused the Framers to forbid the Federal government repeating the defects of the King’s transportation monopoly in the Constitution. Divided Sovereignty separates Federal war-powers from commercial interests.